Pentair PLC is exploring a sale of its slumping valves-and-controls business, a move that would largely unwind a merger deal it struck just four years ago.

Pentair is working with investment bank Citigroup Inc. on a potential sale of the business, which could fetch more than $2 billion, people familiar with the matter said.

Pentair, which is based in Manchester, U.K., acquired the valves-and-controls business as part of a $4.5 billion deal with Tyco International Ltd. in 2012. The deal enabled Pentair to move its headquarters abroad, where taxes are lower. While the deal added other businesses, what Pentair is now considering selling represented a large part of it.

But the valve business' results are weakening, with its sales down 10% year-over-year in the first quarter and its income falling 54%, in part because of declining energy demand. Executives have predicted an 8% drop in full-year revenue for the unit.

The business, one of four subdivisions of Pentair, makes valves, fittings and controls for machinery used by oil- and-gas, power and pharmaceutical companies. It has been hit by a slowdown in spending by energy-industry customers as a result of the sharp drop in oil prices.

On the company's earnings conference call in April, Pentair Chief Executive Randall Hogan said the three other units were positioned well, but the valves-and-control business won't grow until at least 2017. The company just hired Dennis Cassidy to be the new leader of the unit.

When asked if he considered himself a potential buyer of rivals in that business, Mr. Hogan said that while Pentair once expected to do that, he was instead focused on slashing costs and improving margins.

"Right now, we're not focused on being a consolidator," Mr. Hogan said, according to a transcript. "We're focused on fixing what we got."

Last year, activist investor Trian Fund Management LP took what's now a 7.9% stake in Pentair, which also makes water- and fluid-filtration products as well as products for protecting electrical equipment, and had a market value of nearly $11 billion Thursday afternoon. Rather than pushing the company to break up or sell itself, as such investors frequently do, Trian said Pentair should consider acquiring rivals and consolidating the fragmented market. Trian's Chief Investment Officer Ed Garden joined the Pentair board.

A sale of the valves-and-controls business would mark the latest effort to unload an acquired business that has disappointed.

Earlier this year, ConAgra Foods Inc. sold its struggling private-label business, Ralcorp Holdings Inc., to TreeHouse Foods Inc. for about $2.7 billion. ConAgra bought Ralcorp for about $5 billion in 2013, but the deal was a drag on operations.

Also this year, Xerox Corp. decided to unravel its largest acquisition ever by splitting into two publicly traded companies, one focused on machinery and the other on services.

More Stories

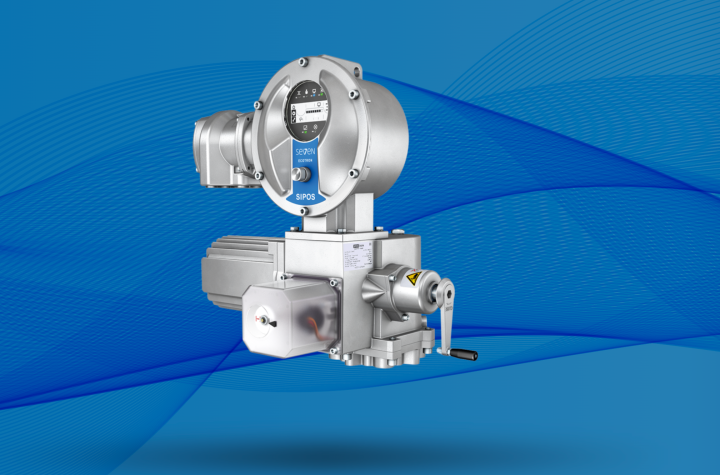

Auma电动执行机构SEVEN HiMod 符合 EN 15714-2 D 级连续工作标准"

罗托克启动首期 5000 万英镑股票回购计划

IMI 在巴西投资建设全新的先进设施