Pentair plc. Ordinary Share PNR hogged the limelight after a WSJ report said the company is exploring a sale of its Valves & Controls business, with a potential speculated price of more than $2 billion.

Pentair plc. Ordinary Share PNR hogged the limelight after a WSJ report said the company is exploring a sale of its Valves & Controls business, with a potential speculated price of more than $2 billion.

The segment, which accounted for about 25 percent of PNR's sales ($1.6 billion) on a proforma basis, has come under pressure after end market headwinds weighed on the results.

However, a Baird analyst says the speculated price is likely too low to justify a sale, which would nevertheless enable Pentair to focus on core end markets. resulting in a higher margin company. It may be recalled that Pentair originally acquired V&C as part of about $4.5 billion transaction with Tyco International plc (Ireland) Ordinary ShareTYC in 2012.

"Speculated sale price would represent -10x our near-trough 2017E EBITDA but would likely be too low to create value from PNR's perspective. While a sale is possible (and a potential catalyst), we recognize that aligning buyer/seller expectations could prove challenging, and we remain Neutral-rated," analyst Michael Halloran wrote in a note.

On the potential acquirers, apart from private equity firms, Halloran said potential strategic buyers include diversified industrials such as ABB Ltd (ADR) ABB, Colfax Corp CFX,Emerson Electric Co. EMR, General Electric Company GE and Honeywell International Inc. HON. Oilfield services players may also be interested on the asset.

"[P]urer play flow companies (ELS, Sulzer, WEIR: less likely n our view, given size)," Halloran noted.

Despite the potential M&A catalyst, the analyst said investors should wait to approach near term until further information materializes-- given the uncertainty of consummating a transaction.

"As such we remain on the sidelines as we look for greater confidence in underlying demand improvement ander confidence in the forward earnings stream emerges," Halloran added.

At the time of writing, shares of Pentair fell 1.22 percent to $60.01. The analyst has a price target of $60.

Pentair plc。普通股的内线占据聚光灯下后,《华尔街日报》的一份报告中表示,该公司正在探索出售其阀门和控制业务,与一个潜在的猜测价格超过20亿美元。段,内线占大约25%的销售额(16亿美元)在形式发票的基础上,受到压力后,终端市场不利因素影响结果。然而,Baird分析师表示推测价格可能太低,不足以证明出售,不过这将使Pentair关注核心市场。导致利润率较高的公司。也许是回忆说,Pentair最初收购维c约45亿美元交易的一部分与泰科国际公司(爱尔兰)普通股yyc在2012年。“猜测售价将代表我们near-trough -10 x -10 e EBITDA但可能创造价值较低的内线的视角。而销售是可能的(和潜在的催化剂),我们认识到,使买方/卖方预期可能是具有挑战性的,而且我们仍然Neutral-rated,”分析师Michael Halloran指出在一份报告中写道。潜在收购者,除了私人股本公司,Halloran说潜在的战略买家包括ABB等多元化的工业有限公司(ADR)ABBColfax集团中国只艾默生电气公司有限公司EMR通用电气公司通用电气霍尼韦尔国际公司。亲爱的。油田服务玩家也可能感兴趣的资产。“[P]你玩流公司(ELS),苏尔寿公司,堰:不太可能n我们认为,鉴于大小),“Halloran指出。尽管潜在的并购催化剂,但分析师表示,投资者应该等到接近短期内进一步的信息实现——鉴于完善交易的不确定性。“等我们依然观望我们寻找更大的潜在需求改善的信心还信心远期收益流出现,“哈洛伦补充道。在撰写本文时,Pentair股价下跌1.22%,至60.01美元。分析师有目标价格为60美元。

More Stories

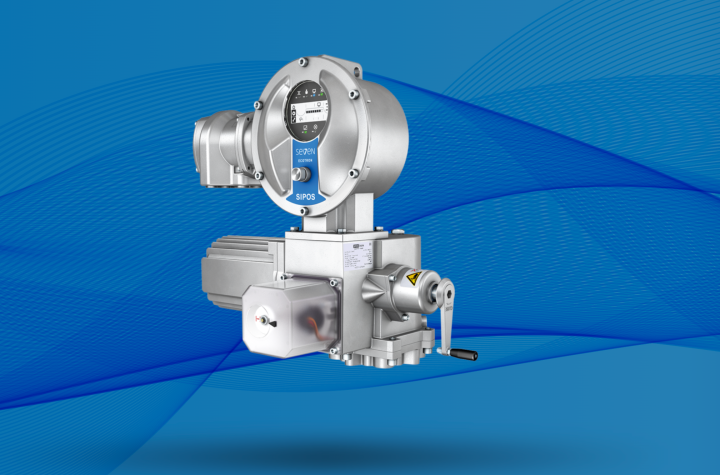

Auma电动执行机构SEVEN HiMod 符合 EN 15714-2 D 级连续工作标准"

罗托克启动首期 5000 万英镑股票回购计划

IMI 在巴西投资建设全新的先进设施